The Pros and Cons of Investing in Real Estate: Understanding the Risks and Rewards

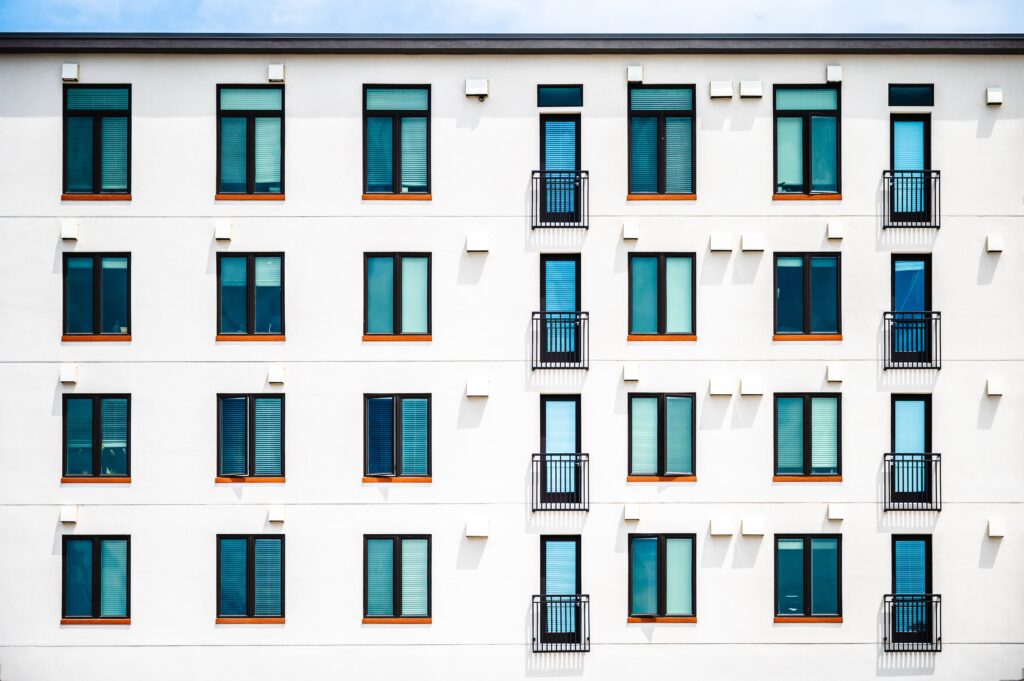

Investing in real estate can be a great way to grow your wealth and secure your financial future. However, like any investment, it comes with its own set of risks and rewards. In this article, we’ll explore the pros and cons of investing in real estate, and how Squareroof makes this process hassle-free.

Pros:

Potential for long-term capital appreciation: Real estate prices tends to rise over time, providing a good opportunity for long-term capital appreciation.

Diversification: Investing in real estate allows you to diversify your portfolio and reduce your overall risk.

Passive income: Rental properties can provide a steady stream of passive income, which can be especially attractive for those looking to supplement their retirement income.

Cons:

High upfront costs: Investing in real estate often requires a large amount of capital upfront, which can be a barrier for many people.

Time-consuming: Property management and maintenance can be time-consuming and require a significant amount of effort.

Market risk: Real estate prices can fluctuate based on market conditions, which can result in significant losses.

This is where Squareroof comes in. Our innovative platform makes it simple to secure a share of income-generating properties, eliminating the barriers to entry and making real estate investing accessible to everyone. Our platform also provides a range of tools and resources to help you manage your investments, reducing the time and effort required to maintain your properties.

In conclusion, investing in real estate can be a great way to grow your wealth and secure your financial future. However, it’s important to understand the risks and rewards involved and make informed decisions. With Squareroof, you can invest in real estate with confidence and peace of mind, knowing that we’ve made the process hassle-free and accessible to everyone.